Before she proceeds further, she wants to know what other aspects of the business are critical to Alpine Group’s growth.Īfter running through the company’s reports and meeting with some executives, here’s what she finds out. Foodservice organizations understanding how open air coolers are merchandised, Independent Convenience Stores where store managers develop their own planograms, and chains that simply only supply planograms to their top suppliers.Dorothea has set up the stores and products, and related them to each other. the left side? These are a sample of questions that can now be answered across each store, a cluster of stores or a region.

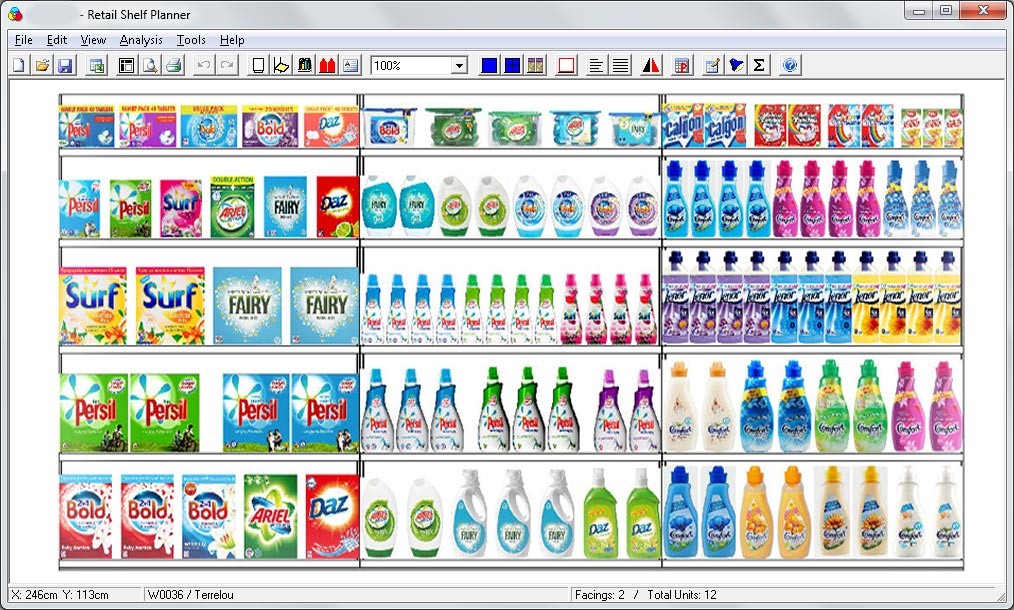

What is the impact of my brand at eye level? What sales lift do I get when a multi-pack is in the planogram? What impact did moving my brands to the right of the planogram vs. CPG’s will integrate point of sale data to develop a store level “cause and effect” analysis of their brands. Others use these gaps to drive execution with their field teams to close gaps.Ĭompetitive Analysis and Planogram ROI. Many CPG’s score compliance and compare across sales organizations or regions determine performance. Given AI algorithms are doing the comparing, compliance can be scaled across very store at a retail chain, a Sales Rep Territory or a Sales Region. Compare the “Real-O-Gram” with what was expected or the Planogram to see gaps. These are the three most popular.Ĭompliance. Once captured, there are many ways the “Real-O-Gram” is leveraged by CPGs and Distributors. The “Real-O-Gram” is captured at store level with a simple photo. Everyone else is left with building their own, trying to determine how their brands are being represented and to make sure stores execute effectively. There can only be one Category Advisor to a retailer, and they have all of the planograms. Asking for a picture of the shelf doesn’t help much since only a few stores might be captured. Begging field sales to manually capture store level planograms needed to build a planogram into Blue Yonder or Relex software is unproductive and unrealistic. As retailers adjust assortment and category size for each store, the difficulty CPG’s have in gathering each planogram is real, time consuming and costly. CPGs are blind to final planograms published to each store. Even major chains hold on to POG, not distributing files to vendors. In some retailers and locations, there are no planograms at all, especially prevalent in the independent retail outlets such as bodegas, coffee shops and convenience stores.

Brands simply don’t have access to Retailer generated planograms.

0 kommentar(er)

0 kommentar(er)